Sage is a traditional ERP provider for small- and medium-sized businesses. Sage 50, Sage 100, Sage 300, and Sage 500 each comprise their own set of market-specific features.

There are, however, some similarities between these Sage products and Acumatica:

-

Feature-rich financial suite;

-

Multi-sector support;

-

Robust third-party software extensions (ISVs);

-

Vast channel of reselling partners (VARs).

Acumatica has wide-ranging ERP functionality, is fully customizable, and is supported by robust ISV software. Contrary to the Sage product line, which is still reliant on aging client-server technology, Acumatica was built for cloud access from its inception, using modern technology. That is why Acumatica can deliver more options and features than Sage and cost less over the long term.

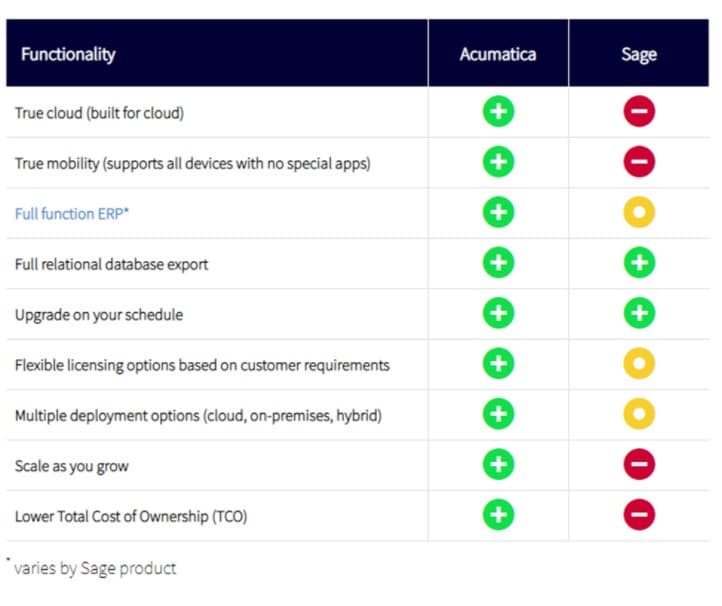

This comparison table provides an overview of how Acumatica performs against Sage:

Key differentiators between Acumatica and Sage

True cloud : True cloud means that all functionalities can be accessed through the Internet using a standard browser and there is no need for the user to install any software on their device or purchase any additional software licences. Much of the Sage product line is supported by older software development technology and platform architecture. These products were designed for on-premises deployment and then retrofitted for the cloud. Moreover, such products also struggle to achieve the level of speed, functionality, and usability offered by a true cloud platform. Acumatica was developed to leverage the capabilities of cloud computing and can operate both on premises and in the cloud. You can even alternate between the two delivery models.

True mobility : Acumatica is a turnkey solution that can be accessed on the device of your choice. Acumatica is designed to adjust the size of each page and each screen to fit the device you are using. Be it on a PC, a tablet, or a phone, each screen has the same information and the same flow. Even though Sage online products are compatible with browser access on various devices, they do not automatically resize web pages to fit on mobile devices.

Full function ERP : The Sage product line compared here is adapted to different business sizes and requirements. Therefore, not all products offer identical ERP functionality. But due to the fact that most of the Sage product line relies on aging 90s client-server technology, these products do not perform at the same level of functionality when deployed in the cloud as they do when deployed on premises. The Acumatica software delivers an integrated financial and ERP solution that can evolve with your business using either a cloud or on-premises model.

Flexible licensing options : Subscription licensing is available for both solutions. Depending on the product, Sage bases licensing on the number of users, either concurrent or named users by specific product. Acumatica provides multiple licensing options and pricing based on resources that your business needs rather than a number of users. This way, your business can grow without incurring additional user costs.

Multiple deployment options (cloud, on premises, hybrid) : Sage and Acumatica have the capability to support on premises, cloud, or hosted deployments. Because of their legacy architecture, most Sage products do not support true cloud deployments. This limitation has significant impacts on Sage product support costs, scaleability, and functionality. Sage products, such as Intacct and X3, are cloud native but cannot be deployed in private/hosted or on-premises modes.

Acumatica offers a fully integrated ERP and CRM solution built on true cloud architecture. In addition, irrespective of whether Acumatica is deployed on premises or in the cloud, you are only charged per system resource, not per user. Of any ERP solution currently available for small- to medium-sized businesses, Acumatica offers the best functionality, performance, usability, and value.

Investing in a new ERP system is a significant commitment that will have a lasting impact on your business. We believe that your next ERP system should be Acumatica. Still, we encourage you to carry out your own due diligence as part of your selection process prior to purchasing an ERP system. Ask questions. Consider all the different answers. Get a real sense of what your business needs will be over the next three to five years.

Take some time to review the ERP software selection resources that Acumatica has put together to help you find the solution that is right for you.

In an ideal world, ERP and CRM systems would play well together. ERP (Enterprise Resource Planning) systems automate processes that focus on customer identification and satisfaction. But because not all ERP and CRM systems are created equal, how well these products integrate depends on the characteristics of the products chosen and the underlying technology platforms they use.

First generation ERP software often lacked essential demand forecasting and customer management tools, so early CRM software was usually offered as a stand-alone application with a separate database.

Today, CRM software is no longer seen as a separate application that’s tacked on to an ERP suite. ERP users now expect business solutions like the CRM to work seamlessly with the ERP system. This integration is especially critical for small and medium-sized businesses (SMBs), since it means a lighter IT workload and reduced onsite investment in system synchronization and new user training.

In recent years, SMB investment decisions seem to reflect a strong preference for connected and mobile solutions. Employees now own on average more than three mobile devices, and companies are increasingly supporting remote work.

The advantages of having a CRM solution connected to your ERP software

Identifying new potential customers is key to developing a business. However, converting potential customers into actual revenue-generating customers is the true driver of growth. Identifying and activating new customers is especially important to small and medium-sized businesses (SMBs). SMBs are typically in direct competition with large companies that leverage greater resources (people) and robust IT systems (ERP and CRM).

Effective management around prospective customers, contacts, leads, and accounts receivable is imperative if your business is to succeed. Knowing exactly what is happening at each stage of the sales cycle (marketing, quote, sale, delivery, and after-sales support) requires a standardized customer management system that the entire organization can use.

As a company expands, it becomes increasingly necessary to standardize systems and put operational processes in place. And failing to do so will limit business growth. A CRM system will track the customer journey, from the creation of the opportunity to its conclusion. The advantages of having a cloud ERP solution connected to your CRM are numerous:

1. Enterprise-wide access to real-time data

At any given time, your employees are interacting with customers. The sales representative is often the first point of contact. They document the sales process and then direct the customer to the warehouse or service department to manage the customer’s order or service. Next, the finance service steps in, to manage the billing and accounting processes.

Using a CRM software that is connected to and integrated with your ERP solution, every department has access to the same (synchronized) data from a single system, in real time. Information-sharing fosters collaboration across the organization. As a result, customer satisfaction is enhanced because stakeholders have timely data to respond to customer requests.

2. Save time with enhanced quote and order management

With the right CRM software, you can easily create quotes and proposals, then simply convert them into orders within your integrated cloud ERP solution. This automated feature delivers significant time savings and convenience for employees and customers alike.

3. Consolidated information improves visibility and forecasting

Most sales teams have weekly and/or monthly meetings to review the status of leads and opportunities. When information is consolidated in a single CRM and ERP application, the time required to prepare for meetings is cut down considerably, as management now has an overview of the entire process.

Moreover, by having a single source for your business-critical information, you can analyze the customer lifecycle, improve efficiencies, and increase conversions.

Which CRM and ERP should you choose?

The key benefits of an integrated CRM and ERP system include improved productivity, smarter decision-making, increased profits and, most importantly, satisfied customers. So how do you choose the perfect CRM software for you and your business? You may want to consider a CRM that is an integral part of a modern cloud-based ERP solution.

One of the unique attributes of the Acumatica CRM solution is that it is fully integrated with the Acumatica platform. You don’t have to process information in multiple locations. So, everyone has access to the same information, whether they are in marketing, sales, customer support, or finance.

The CRM is a valuable tool that delivers a team-driven approach to sales and service. The solution comprises a customer self-service portal and the CRM Add-in for Microsoft Outlook, which works with inbound and outbound email in Outlook, enabling users to:

-

Search existing prospects, contacts, and employees in the CRM;

-

Access an existing contact in one click;

-

Create new leads and contacts directly from the inbox;

-

Add opportunities and cases to existing contacts;

-

Record activity and attach email content to CRM.

While the advantages of integrated ERP and CRM software can help SMBs identify new leads and support growth, the cost of installing and maintaining these systems is often out of reach. But cloud computing is changing all that.

Cloud-hosted ERP and CRM solutions are a cost-effective way for SMBs to grow their business. Access to such systems requires a lower cash investment than for traditional licensed software.

Tips for a successful implementation

Achieving a smooth transition from traditional, disconnected CRM and ERP software to a single, modern, integrated solution comes down to one thing: communication.

Make sure you let your team know your plan to integrate your CRM and ERP systems—before you actually proceed. They’ll appreciate the heads-up. It will also give them a chance to explore the benefits and come up with ideas around what they would like the integration to look like.

Leadership buy-in is another critical part of successful technology uptake. First you must clearly communicate that the executive team is on board with CRM and ERP integration, along with the many benefits associated with this decision. Then, the following steps will help make the implementation process a winning experience for your entire company:

1. Understand what your sales process will look like before you buy a CRM solution and before you proceed with the implementation

Your sales methodology will vary depending on the type of industry you are in, the customers you serve, and the products you offer. Define your sales process and tailor your CRM solution to fit your process. Make sure the solution you choose is customizable enough to give you the flexibility you need.

Our advice is for you to think about your business, not just as it is today, but as it will be in two, three or five years, and to make your decision based on the demographics and prospects you want to attract in the future.

2. Avoid a “Big Bang” implementation

Have your sales team start by entering small data into the system. Then show them a portion of the information they can extract from it. As they become more comfortable working with the system—inputting greater amounts of information—your sales team will realize how much data they can collect and how much knowledge they can gain about their clients.

3. Provide appropriate training and the opportunity to give feedback

You’ll want to provide appropriate training, outlining to employees what they will gain from the new CRM and ERP system. Don’t expect them to convert fully unless you give them the opportunity to offer feedback. Whenever something is new, it takes most people a little time to get on board. This is a collaborative effort among all teams, which will result in better information sharing, and a win-win for the whole organization.

Ready to make the switch?

Would you like to know more about the Acumatica cloud-based ERP? Connect with our team and start managing leads, improving conversions, measuring campaign performance, and more, from anywhere.

A significant number of distribution companies still have only limited access to e-business, be it for lack of resources (human or financial), lack of expertise, or more simply for lack of products adapted to today’s reality.

For both information exchanges and transactions, an SMB’s management systems can now communicate directly with systems used by its suppliers, partners, banks, customers, employees, governments, or even its accounting professional.

An enterprise resource planning (ERP) system is designed to be a fast and simple way to meet these needs. It allows companies to manage most of their operations centrally and provides up-to-date information on critical items such as budgets and revenue growth.

In contrast to silo-based systems, an ERP system serves as a central point of contact to efficiently manage the inner workings of the distribution business. Although this can seem complex, particularly for SMBs, the benefits of this approach can help:

-

Streamline internal operations

-

Strengthen customer relationships

-

Simplify administrative tasks

-

Reduce costs

- Improve productivity

Organizations must then assess which of their distribution activities would provide the best opportunity for cost reductions, efficiency and profitability gains, or more flexibility in their operations. Here are five ways an ERP solution can help you continue to grow your small business:

Enhance financial management performance

Despite their individual characteristics, every company wants to manage its finances as efficiently as possible. Too often, poorly organized systems make this task more difficult.

Management software puts an end to the inefficient tracking which relies on disparate spreadsheets and multiple manual operations that take up a lot of time and create opportunity for human error. An SMB needs accurate information, presented in a systematic and efficient manner, in order to have an optimal overview of the company and its operations.

Payment and billing systems are also a headache for anyone who is trying to get by with outdated software or inadequate tools. Even the best employees have their limits. And so does your accountant.

Too much work eventually leads to more mistakes. Using an ERP system is like hiring an assistant to help you with your daily activities. With the right management software, companies are better equipped to manage payments and automate invoicing, adjusting currencies as needed.

Improve operations and supply chain management

ERP provides a complete view of a company’s operations and enables leaders to drill down on key drivers, such as profitability, cost, and budget management.

Inventory management is a challenge for all growing SMBs. Small businesses must keep enough product in stock to meet demand, while also making sure they don’t over order.

After all, no business wants to be saddled with hundreds of items just sitting in their warehouse. With an ERP system, you can also reserve products that are in the receiving process at the warehouse to handle more urgent customer orders.

For instance, you could set a minimum inventory level to be maintained. This way, you will not be caught unprepared when there is a sudden spike in your sales or a stockout with your main supplier.

A common mistake made by SMBs with multiple branches is to manage inventory in silos. For example, one warehouse may have several products sitting idle, while another may be out of stock for that same product. If the different branches do not have the same inventory management tool, they do not have a way to help each other.

Finding the right balance is not always easy, and there are many hurdles in the supply chain. Learn about some common inventory management mistakes.

Provide a better customer experience

Customers are looking for accurate answers supported by up-to-date information. With spreadsheets, however, your customer service associates may not have the most current information available. Customer service associates must wait for the spreadsheet to be updated at the warehouse, which may cause unwanted delays in responding to their callers.

With management software, every employee involved, from the head office to the warehouse, has immediate access to the most reliable data, which they can then easily pass on to customers.

Clearly, these gains in efficiency on day-to-day activities will improve delivery processing. With automated purchase orders and simplified packing slips, your teams can complete tasks more quickly. Deliveries will take less time to arrive, and sales will move in the expected upward direction.

Secure data storage

Data management relies heavily on keeping corporate records secure and having structured processes in place. Even a single incident of hacked accounts or stolen data is cause for alarm for any business operator.

Hackers intending to steal customer data from an SMB equipped with a management solution will face an exceedingly difficult task. They will have to overcome multiple complex security mechanisms. Conversely, hackers will have no trouble breaking into an employee’s workstation to steal a customer list in Excel format.

Consider the consequences if that information were then published on the Web—reputations could be severely damaged. Essentially, an ERP solution will streamline the way distribution companies manage their current and potential customer information and keep the data secure.

Enable executives to access data remotely

The leaders of fast-growing businesses have too much to do to deal with systems that can’t keep up. Consider a large accounting firm that has grown significantly in recent years. Its executives are constantly travelling on business.

During peak periods, they are out of town about two weeks a month, meeting with customers and monitoring ongoing operations. Because they are frequently away from the office, they need a management system that can be accessed from any device.

Many software systems require a desktop setup and cannot be used with a tablet. ERP solves this issue by enabling users to work from anywhere, provided they have an internet connection. Executives can oversee key business operations from any location.

Is it time to change your ERP system?

Choosing the right ERP system for your distribution business is critical. Implementing an ERP system requires preparation, time, and effort, but the resulting company-wide benefits are undeniable.

An ERP solution is nothing less than a cost-effective platform that centralizes financial, operational, and data management. It allows businesses to track costs and operations, while also simplifying report access and creation.

Take a look at our success stories or contact the ACCEO ERP team to learn more about the Acumatica platform.

For many companies, the decision comes down to choosing between Oracle NetSuite and Acumatica.

Which one will you choose?

- Acumatica and Oracle NetSuite offer cloud-based SaaS ERP applications;

- Both solutions integrate ERP, CRM, e-commerce, and business intelligence;

- Both solutions support multiple industry verticals, from retail to distribution to manufacturing.

Here is how Acumatica and Oracle NetSuite compare :

Key differentiators between Acumatica and Oracle NetSuite

Full relational database export : Oracle NetSuite users are not able to export their data directly into a relational format, so migrating their data is difficult and costly. Acumatica will never keep your data captive. You have access to a fully relational copy of your data at all times using the built-in automated backup service and snapshot feature.

Customization using industry standard tools : Both products can be configured to a great extent, but only Acumatica is built using C# and .NET standards. Customization is more difficult with Oracle NetSuite because it uses proprietary development tools.

Updates on your timeline : As a way to manage its multi-tenant model, Oracle NetSuite sets restrictions on when users can upgrade their software, and the option comes at extra cost to the client. Conversely, users can update at any time with Acumatica.

Flexible licensing options : Both products are available through public cloud subscription licences (SaaS). Acumatica, however, makes additional pricing options available to clients to accommodate their unique requirements.

Multiple deployment options (cloud, on premises, hybrid) : Both products are available in the cloud. Only Acumatica can carry out on-premises and hybrid deployments for those businesses that need to keep their sensitive data within the organization.

TCO : Acumatica charges computing resources used. Oracle Netsuite charges both by computing resources used and also by user. User costs will continue to go up as your business grows. Over time, these costs will rise and increase your total cost of acquisition.

About Oracle NetSuite

NetSuite was originally founded in 1998. In 2007, it became a publicly traded company and was subsequently acquired by Oracle in 2016. Because Oracle NetSuite was written before most of the newer web technologies were standardized, it has limitations around deployment options, customization language, and database export capabilities.

By contrast, Acumatica was designed from the outset for accessibility both through the cloud and on-premises using modern web technology. Additionally, you have access to your data at any time, flexible licensing options, and the freedom to add users at no extra cost, which will lower the total cost of ownership for your business.

For small and medium-sized businesses, Acumatica delivers top value, performance, functionality, and usability among the ERP products currently on the market.

A 100% ERP cloud solution to manage your business wherever and whenever you want. See an overview of Acumatica Cloud ERP

Cloud ERP software enables companies to access their business applications any time, anywhere. There are zero upfront costs for data servers and hardware. And there are few, if any, IT support services required, as enhancements and upgrades are in the hands of your service provider. The downside is that costs associated with cloud licences could slow down your growth.

Pricing based on your needs

-

The applications you want to use now (all applications are integrated and can be added at any time)

-

The type of license you choose (SaaS Subscription, Private Cloud Subscription or Private Perpetual License) with the option to change without penalty

- Your projected level of consumption (based on the volume of your business transactions and storage)

As your consumption level rises and falls over time, you can adjust your resource and data storage levels up or down as required. Moreover, since you don’t have to worry about paying for a per-user licence, employees can all access your cloud ERP solution at the same time, meaning they all have access to real-time data and can make decisions based on the same version of the truth.

Paying for resources used rather than per user has a significant impact on a company’s ability to grow.

Boost your growth with Acumatica ERP

Companies from different sectors and with different business management needs have chosen our affordable, consumption-based pricing over our competitors’ more restrictive licensing. Our customers can add users at any time—worry-free. They know that that no costly additional licenses are required, whether for occasional users, suppliers, or customers.

Here’s what customers are saying about Acumatica ERP’s modern pricing structure:

“Acumatica ERP was the most affordable high-value solution. It stood out as the top solution for its unlimited user licence and easy customization.”

“The licensing structure with Acumatica is about resources and usage and not about the number of users we have. We are expanding into new markets with the confidence that Acumatica ERP can sustainably manage increased transactions and growth for many years to come.”

“Competing providers expected us to pay per user, which was not affordable.”

Become a successful business

Your business—and businesses in every sector—must grow to remain relevant and prosperous.

That growth is achievable with consumption-based cloud ERP pricing. Our commitment is to protect your business from questionable business practices. If your current cloud ERP licence is stifling your growth, turn to Acumatica ERP. We can support your growth at a fraction of the cost. Contact our experts today to talk about your business goals.

Small and medium-sized businesses (SMBs) that are considering introducing a new ERP system or replacing their existing system face a unique challenge. Their operations management can be as complex as that of larger companies: supply chain management, customer relations, overseas operations, and so on. It follows that in order to meet their intricate requirements, SMBs need an ERP system that performs the same advanced of functions as those used by large multinationals.

Too small for a big investment?

The glitch for SMBs is that although the range of features offered by large conventional ERP solution providers are usually suited to their needs, these costly solutions come at a price that by far exceeds their smaller budgets. Moreover, “traditional” ERP solutions are typically designed to be deployed and maintained in-house while SMBs generally do not have the IT resources (such as a team of technicians and IT infrastructure) to deploy, operate and maintain an ERP system internally. So, in order to fully implement the ERP system, SMBs then also face additional investments in computer equipment, network infrastructure and personnel. Ultimately, the scope of implementing a large ERP solution leads to costs that are well beyond the reach of most SMBs.

Too big for a more affordable system?

In terms of performance, many of the more affordable ERP solutions offer fewer functionalities, which means that they do not meet the requirements of the small and medium-sized business whose activities include distribution, retail, services, manufacturing or overseas business. These more affordable ERP solutions also lack the flexibility and scalability necessary to integrate new technologies that will evolve and grow with the business.

Are you sacrificing growth to preserve the status quo?

Far too many SMBs postpone the decision to implement a new ERP system because they consider their business too small to justify acquiring an ERP solution or replacing their current obsolete system. Some small and medium-sized enterprises simply want to avoid a significant short-term expenditure or an interruption of operations during the implementation. Other SMBs have always operated without an ERP and consider that they can continue to operate effectively using the same business practices. Finally, several companies believe that the internal challenges of implementing ERP software are far too demanding.

Most troubling among these examples, is the situation where companies naively trust (let’s not mince words) that they can continue to manage their operations—and that their business can remain viable into the future—without ERP software. It is possible to draw two conclusions from this perspective: either these SMBs do not anticipate any growth in the years to come, or they simply do not know the extent to which their technological standstill is blocking their business growth.

The consequences on your operations… and your competitiveness

Not using ERP software can have potentially disastrous consequences: redundant or inaccurate data, disparate computer systems that can neither communicate with one another nor track business processes, unreliable data sharing, lack of internal collaboration, and many more.

As for those SMBs that already have an ERP system, many are relying on legacy systems that run on outdated technologies and they are reluctant to replace them. This failure to take action also comes with its share of consequences that will ultimately compromise their ability to remain competitive. Businesses that leverage the most current version of their ERP system consistently outperform those using older technology in areas like average days sales outstanding, complete and on-time delivery, adherence to internal timetables, inventory accuracy, percentage of financial report accuracy, timeliness of data availability, and customer satisfaction.

Cloud-based systems: affordable and feature-rich

Any SMB with eye toward growth needs to operate with an ERP software and cannot afford to keep using an obsolete system. The good news is that even the smaller budget can now access an ERP solution that offers advanced features and scalability. It’s all about cloud computing. Cloud-based ERP systems offer feature-rich and flexible solutions that will evolve with the SMB. Because these solutions are web-based (and hosted by the service provider) and updates are typically included in the offer, choosing this option means SMBs get all the benefits of the latest technology and none of the expenses of acquiring additional hardware, maintaining an IT infrastructure, or hiring staff to support the software. Another significant advantage of cloud-based ERP systems is that they are generally simpler, faster to install and are accessible from anywhere, at any time, and on any device (laptop, desktop, tablet or smart phone).

So, are you still convinced that your decision can wait?

To get a conversation going with your decision-makers around the ROI (Return on Investment) of a process, tool, or product, it’s a good idea to start with a quick overview of the benefits. But discussing the bottom line benefits needs a deeper dive and some complex ROI calculations. When talking about ROI on ERP systems, it’s no simple task to create the equation that identifies the investment side of the ROI.

Here’s the make or break element when presenting an assessment of ROI — Make the complex ROI calculations more approachable so as not to discourage anyone who might be considering a new ERP implementation.

Because ERP projects are often associated with overruns, ERP implementations are typically received with tepid enthusiasm. Time overruns can sometimes be traced to a breakdown in project management processes or team dynamics. As for cost overruns, they generally result from underestimating cost components and undervaluing certain aspects of the project.

There’s a simpler way to provide true estimates of the cost of ERP software investment and break away from the cycle of overruns. The ERP ROI analysis starts by defining each element, determining the number of items that comprise each element, and identifying the cost per item.

After assessing the many factors to consider, we’ve come up with the five key cost calculations that are likely to impact the ERP software solution you choose to implement:

1 – Determining the Cost of New Hardware and/or Upgrades

Your current ERP software is likely installed on an existing IT infrastructure. There are now Cloud-based ERP solutions and SaaS configurations, which allow service providers to offer many ERP software acquisition, deployment, and usage options.

In choosing which solution is best suited to your business, think about on-premise or cloud ERPs, then factor in the cost of hardware acquisition and/or upgrade, additional servers and/or telecommunications equipment.

Normally computer hardware is purchased, recorded as an asset, and depreciated over its useful life. The additional depreciation in terms of reduced taxes, or improved cash flow should be reflected as a benefit (Return) in your ROI calculations.

2 – Buying a Software Licence or Service

In the past, software licences were purchased, capitalized and depreciated over their useful life, just like hardware. Software-as-a-Service (SaaS) subscription configurations have now dramatically changed how ERP software is purchased and used. So much so that the accounting industry has been challenged in providing clear instructions on how to correctly account for fees paid in a SaaS arrangement.

To offer some clarity on the issue, the Financial Accounting Standards Board (FASB) recently proposed some guidelines to define the accounting treatment of SaaS arrangements. Under the new recommendations, cost elements for fees paid within a SaaS arrangement that includes a software licence element, must be identified and treated just like any other software licence—meaning that they must be capitalized and depreciated over their useful life. However, when the SaaS arrangement does not include a software licence, the cost elements must be charged to operating expenses, just like a service contract.

Clearly, this differentiation of a software acquisition made under an on-premise or SaaS arrangement will impact your evaluation significantly. So the decision must be factored into the ROI calculations on your ERP project.

3 – Customizing Software

ERP products on the market today can provide systems that will very closely fit your business needs. Still, most projects will require some degree of customization. Fortunately, some of these customization costs of ERP implementations can be capitalized and depreciated, adding to the financial benefit of the ROI analysis.

This benefit comes with a cautionary note. Software customization is the single most underestimated ERP implementation cost component and can potentially derail your project or radically impact ROI calculations. What is more, unanticipated software customization costs and delays will impact the full scope of an ERP implementation project.

4 – Factoring External Consulting and Implementation Cost

From an accounting perspective, the total costs of the implementation efforts cannot be capitalized as part of the acquisition cost. However, it is important to identify theses costs and include them in the investment component of the ROI calculations.

External consulting or project management services costs, along with temp services costs, should be included. The ERP implementation must also identify and estimate initial training and data conversion costs.

5 – Evaluating Ongoing Costs

Post-implementation, there are maintenance costs to consider over the useful life of the ERP software. In both on-premise and SaaS configurations, software maintenance fees will customarily be defined when you purchase an ERP system. Your ROI analysis needs to determine the cost of training new staff, or retraining existing staff when software upgrades are installed, as ongoing expenses in order to maintain—and capitalize—your ERP investment.

ERP software is a powerful resource that can take your business up to the next level. With due diligence, a complete and accurate ROI assessment can ensure that your company makes informed decisions up front, acquires the best ERP system for your needs, and is empowered to fully realize the benefits of a new solution.

When you first started your business, you decided to manage your finance operations with Acomba or Avantage. You made the right choice. Acomba and Avantage are ideal accounting software for small businesses. If your growing business is using Acomba or Avantage, you may be finding that the software is reaching its limits and are looking for a new solution.

Here are 8 signs that you have hit the limits of Acomba or Avantage :

1. Your software has become so slow that it is holding you up. Your current management software was designed for small businesses. It is therefore not optimized to process the large amount of data produced by a growing business. Database slowdowns can even bring your operations to a complete standstill. Such cases require technical interventions to rebuild the entire indexing system, which then lead to delays and disruptions.

The exchange of information between your different concurrent systems is too voluminous to be efficient.

You are using multiple software that is not integrated. Without integration and centralization, you are having to enter data multiple times. And because your software is not integrated, your data is difficult to analyze.

Furthermore, there are times when you have to re-enter the same information or transfer the date manually, thereby increasing the risk of errors.

All these issues obstruct visibility into your overall business performance.

2. You require access to your software’s full functionality from anywhere at any time. A cloud-based ERP will deliver many benefits. Beyond improving the efficiency of most services, it adapts easily to your business needs. Cloud computing allows you to access your data and reports over the Internet, wherever you are, regardless of the equipment you use (tablet, cell phone, laptop, etc.).

3. You are struggling to get an accurate view of your inventory in real time vous offre de nombreux avantages. En plus d’améliorer l’efficacité de la plupart des services, il s’adapte facilement aux besoins de votre entreprise. L’infonuagique vous permet d’accéder à vos données et à vos rapports où que vous soyez grâce à Internet, et ce peu importe l’équipement utilisé (tablette, cellulaire, ordinateur portable, etc.).

4. Because your inventory is valuable and tangible, it is often one of the first places where you cut costs. And inventory is a key measure of your overall business health. With the Acumatica ERP, you get real-time visibility into inventory cost and location in one or more warehouses. The replenishment features use smart algorithms to suggest order volumes in advance, based on the seasonality of your purchases.

5. You need an advanced financial structure (intercompany, multicurrency, automated entries, reinvoicing, intracompany). Has your business grown into a multiple-company organization? Intercompany accounting gives you the ability to track financial statements and create reports separately for an unlimited number of associated companies.

If these businesses are based in multiple locations, you need a solution that has the capability to issue invoices and collect payments in any currency. Acumatica ERP manages client balances in both base and foreign currencies. Automatic currency conversion allows for real-time adjustments, currency triangulation, and profit and loss calculations.

In addition, when entering invoices, it is immediately possible to allocate expenses for automatic reinvoicing to your other companies, either for a single invoice or for recurring invoices. Using the Acumatica ERP, you can considerably reduce the time spent balancing entries.

6. You are relying on spreadsheets to consolidate your information. Admittedly, Excel will cost you less than a true ERP solution. However, having to analyze your operations on multiple spreadsheets can quickly become very complex. And complicated operations will have a negative impact on your performance. In which case, it is best to invest in ERP software that is specifically designed to help you save time, improve productivity, and grow your business over the long term. You can then centralize information from other systems into your ERP software and take full advantage of the 360-degree visibility that integrated dashboards provide.

7. Your reports take too long to produce, and you need access to custom reports and dashboards. You get deeper insight into your organization with Acumatica. You will have the ability to view your data in real time on your customized dashboard and analyze trends in a timely manner. These features help you produce fewer reports more easily, because your latest key business data is always available directly in your dashboard or other modules.

The Acumatica ERP delivers a range of powerful reporting and analytical resources that can make your work easier and more efficient. Learn more.

8. You month-end accounting operations are a nightmare. When you move to an ERP solution, many of your accounting transactions will be automated. Manual tasks and duplicate data entries regularly cause accounting errors which often occur at a critical time like month end. Automated processes and data flow in the Acumatica ERP will save you time and allow you to close your books sooner.

Is your business ready for a complete ERP system?

In support of your business continuity and growth, contact us for more information!

Since its foundation in 1990, Technorol has secured its reputation as a premier supplier specializing in consumables products for and graphic arts markets and industrial.

Over the last 30 years, Technorol has experienced sustained growth through various acquisitions which have enabled the company to diversify its offering, provide ever-increasing levels of service, offer technical support and training on products, and processes.

Challenges

Over the course of its expansion, Technorol had acquired multiple stand-alone systems to manage its operational and financial needs. This disconnected patchwork of systems left the company with no real-time access to inventory, making it difficult to track essential production materials. Additionally, complex financial management, accounting operations, and inter-company postings had become major sticking points in day-to-day operations and during closing periods. Their operations were being hindered by:

-

Complicated purchasing and inventory processes

-

Out-of-date inventory information

-

Failure to track purchase orders

-

Multiple manual operations on Excel files

-

Absence of financial tools to support inter-company operations

-

Repeated entry of the same data into different systems

-

Inability to obtain timely and accurate overview across all operations

Solution

As long-time satisfied users of the Acomba and Avantage software, Technorol chose to partner with the ACCEO ERP team for their transition to an integrated solution. ACCEO’s analysts and implementation specialists ensured that every phase of the transition proceeded as scheduled. Concurrently, the data migration process was carried out precisely and was completed quickly and seamlessly. Upon completion of the migration to the Acumatica ERP, Technorol’s operations had successfully upgraded to a lead-edge comprehensive business management system that offered:

-

Cloud-based solution

-

Fully integrated system

-

Advanced financial management capabilities (multi-company, automated entries, reinvoicing)

-

Cross-divisional transaction tracking

-

Enhanced business intelligence tools

-

Proven business analytics with data drill-down capabilities

-

Full-featured dashboard available from anywhere

“We can perform our financial operations faster, which saves us time and increases our productivity. We have reduced our month-end and year-end processing time by 50%. Additionally, we have cut down our inventory management time from two weeks to one day.” – Mélynda Couture, Finance Manager, Technorol

“Our previous software systems were not designed as an ERP solution. Upgrading to the Acumatica Cloud ERP has supported our business continuity and growth. We are more agile now that we have real-time visibility across the entire business.” – Stéphane Fortin, President, Technorol

Results

Since transitioning to the Acumatica cloud-based ERP, Technorol has been leveraging the dashboard to make fast and informed business decisions from anywhere. Managing multiple companies from a single integrated platform has made them gain efficiencies. In addition, inventory information is current and accurate, and data entry time is now cut down. On a more basic but impactful level, every Techonorol division has gained daily efficiencies using one centralized customer data for mailing holiday cards, pricing lists, promotional information, and more.

Is it time to replace your ERP software?

Tell us about your project. For our team, it is an opportunity to contribute to the success of a local company and to undertake a winning partnership.

Contact our ACCEO ERP team to learn more about the Acumatica platform.

Groupe Dermapure’s core activities are focused on skin health and care. The group offers its products and services through a network of 33 clinics across Canada and its online store.

Since 2009, the group has continued to grow its position as a leader in the field of medical aesthetics and currently employing over 300 dedicated staff, including 50 doctors and specialists.

As Groupe Dermapure has grown, so have its requirements in terms of operations, personnel, financial and accounting management, across multiple clinics in different parts of the country.

Challenges

As the group’s operations were in rapid expansion, so was its need for an integrated financial management system that would, among other things: standardize financial processes, automate accounting across its multicompany structure, support an expanding product offer, and expedite and streamline integration procedures for future branches. Some of the factors hindering their development efforts were:

-

Lack of a common chart of accounts

-

No intercompany transaction functionality

-

Key functions (asset management, expense reports, etc.) processed in Excel

-

Multiple manual operations on an unmanageable number of standalone software

-

Reporting delays caused by unconnected systems

-

Data inconsistencies due to repeat data entry

-

Absence of analytic tools for overall view on clinics across the country

Solution

In 2021, one of the key elements in Dermapure’s sustainable development plan was to acquire an integrated, user-friendly, and evolving solution to support their continued growth. The group had been leveraging some of ACCEO’s standalone software solutions for several years and, based on their high level of satisfaction and customer service experience, determined that that Acumatica ERP was the top solution to provide:

-

Customizable and expandable cloud-based solution

-

Comprehensive fully integrated system

-

Advanced intercompany and multicompany transaction functionality

-

Centralized and automated data processing

-

Enhanced finance and accounting capabilities across the business

-

Real-time business analytics with data drill-down features

-

Dashboard available from anywhere

“The Acumatica Cloud ERP delivered in key areas such as supporting our current and future business growth and our product offer. We have been able to eliminate redundant manual processes and gain significant efficiency by leveraging the system’s integrated automation and standardization capabilities throughout our network of clinics. Since the implementation of Acumatica Cloud ERP,

Groupe Dermapure has undergone significant development. In fact, if we go back in time, it had 18 clinics and 2 online stores. Today, it has 68 clinics and 2 online stores.”—Caroline Désorcy, Finance Manager, Dermapure

Results

From a high-level perspective, having a common chart of accounts, Groupe Dermapure has enabled Groupe Dermapure to get thorough financial and organizational insights from their business operations. Additionally, the group has optimized its fixed asset management with features that offer multiple depreciation methods, purchase order integration, and tax benefit support.

In day-to-day activities, enhanced bank reconciliation processes, expense account approvals, EFTs, batch payables, and intercompany transactions continue to produce significant savings in time and resources.

Is it time to replace your ERP software?

Tell us about your project. For our team, it is an opportunity to contribute to the success of a local company and to undertake a winning partnership.

Contact our ACCEO ERP team to learn more about the Acumatica platform.